David Shands' net worth is an estimate of the total value of his assets minus his liabilities. It is a measure of his financial wealth and is often used to assess his overall financial well-being.

David Shands' net worth is important because it can provide insights into his financial success and can be used to compare his wealth to others. It can also be used to track his financial progress over time and to make informed decisions about his financial future.

There are a number of factors that can affect David Shands' net worth, including his income, expenses, investments, and debt. It is important to consider all of these factors when assessing his overall financial health.

david shands net worth

David Shands' net worth is a measure of his financial wealth and is often used to assess his overall financial well-being. It is important to consider all of the following key aspects when assessing his net worth:

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Debt

- Financial goals

- Risk tolerance

- Investment strategy

- Tax planning

David Shands' net worth is not just a number. It is a reflection of his financial health and well-being. By considering all of the key aspects listed above, he can make informed decisions about his financial future and achieve his financial goals.

Assets

Assets are resources that have value and can be converted into cash. They are an important part of David Shands' net worth because they represent his ownership of valuable items. There are many different types of assets, including:

- Cash and cash equivalents: This includes money in the bank, money market accounts, and other liquid assets.

- Investments: This includes stocks, bonds, mutual funds, and other investments that have the potential to grow in value over time.

- Real estate: This includes land, buildings, and other real property.

- Personal property: This includes cars, boats, jewelry, and other personal belongings.

The value of David Shands' assets can fluctuate over time depending on market conditions and other factors. However, by owning a diversified portfolio of assets, he can reduce his risk and protect his net worth.

Liabilities

Liabilities are debts or obligations that David Shands owes to other people or organizations. They are an important part of his net worth because they represent his financial responsibilities. There are many different types of liabilities, including:

- Credit card debt

- Student loans

- Mortgages

- Car loans

- Personal loans

The amount of David Shands' liabilities can have a significant impact on his net worth. High levels of debt can reduce his net worth and make it more difficult for him to achieve his financial goals. However, by managing his debt wisely, he can reduce his risk and protect his net worth.

One of the most important things David Shands can do to manage his liabilities is to make sure that he is only borrowing money for things that he can afford to repay. He should also make sure that he is not borrowing more money than he can handle. If he finds himself in a situation where he is struggling to repay his debts, he should seek help from a financial advisor.

Income

Income is an important part of David Shands' net worth because it represents his ability to generate wealth. Income can come from a variety of sources, including wages, salaries, self-employment, investments, and other sources. The more income David Shands earns, the greater his net worth will be.

There are a number of ways that David Shands can increase his income. He can negotiate a raise at his current job, start a side hustle, or invest in income-generating assets. He can also reduce his expenses to increase his disposable income.

By increasing his income and reducing his expenses, David Shands can improve his net worth and achieve his financial goals. However, it is important to remember that increasing income is not the only way to increase net worth. David Shands can also increase his net worth by reducing his liabilities and investing wisely.

Expenses

Expenses play a crucial role in David Shands' net worth. They represent the outflow of money from his financial resources, directly impacting his overall financial standing.

- Fixed Expenses: These expenses remain relatively constant from month to month, such as mortgage or rent payments, car payments, and insurance premiums. Managing fixed expenses effectively can help David Shands maintain financial stability and plan for future investments.

- Variable Expenses: These expenses fluctuate based on consumption patterns, including groceries, entertainment, and dining out. David Shands can optimize his net worth by controlling variable expenses, prioritizing essential purchases, and seeking cost-effective alternatives.

- Discretionary Expenses: These expenses are non-essential and provide enjoyment or leisure, such as travel, hobbies, and personal care. David Shands' net worth can benefit from mindful spending in these categories, finding a balance between financial well-being and personal fulfillment.

- Unexpected Expenses: Life often presents unexpected financial challenges, such as medical emergencies or car repairs. David Shands can mitigate the impact of these expenses by maintaining an emergency fund and considering insurance options to protect his net worth.

By carefully managing his expenses across these categories, David Shands can optimize his net worth, achieve financial goals, and secure his long-term financial well-being.

Investments

Investments are a crucial component of David Shands' net worth, offering potential growth opportunities and shaping his long-term financial well-being.

- Diversification: David Shands can spread his investments across various asset classes like stocks, bonds, and real estate. This diversification strategy helps reduce risk and balance his portfolio, contributing to the stability of his net worth.

- Growth Potential: Investments have the potential to appreciate in value over time, particularly in growth-oriented assets like stocks. By investing wisely, David Shands can harness the power of compounding returns and increase his net worth significantly.

- Income Generation: Certain investments, such as bonds and dividend-paying stocks, can provide regular income streams. This passive income can supplement David Shands' other sources of income and contribute to his overall financial security.

- Tax Optimization: Strategic investments can offer tax advantages, such as tax-deferred growth or tax-free income. By leveraging these opportunities, David Shands can minimize his tax liability and enhance his net worth.

In conclusion, investments play a multifaceted role in David Shands' net worth. Through diversification, growth potential, income generation, and tax optimization, investments contribute significantly to his financial well-being and long-term financial goals.

Debt

Debt is an important factor in David Shands' net worth. It represents the amount of money that he owes to others, and it can have a significant impact on his financial health. High levels of debt can make it difficult for him to save money, invest for the future, and achieve his financial goals. On the other hand, managed responsibly, debt can be a useful tool for building wealth and increasing net worth.

There are two main types of debt: secured debt and unsecured debt. Secured debt is backed by collateral, such as a house or a car. If David Shands fails to repay a secured debt, the lender can seize the collateral. Unsecured debt is not backed by collateral. This makes it riskier for lenders, and as a result, unsecured debt typically has higher interest rates than secured debt.

David Shands should carefully consider his debt before making any borrowing decisions. He should only borrow money for things that he can afford to repay, and he should make sure that he understands the terms of the loan before he signs on the dotted line.

Financial goals

Financial goals are an important part of David Shands' net worth. They provide him with a roadmap for how he wants to use his money and achieve his financial objectives. Without financial goals, it is easy to get sidetracked and spend money on things that do not align with his long-term financial interests. By setting financial goals, David Shands can make more informed decisions about his spending and investing, and he can track his progress towards achieving his financial objectives.

There are many different types of financial goals that David Shands could set. Some common goals include saving for a down payment on a house, retiring early, or funding a child's education. Once David Shands has identified his financial goals, he can start to develop a plan to achieve them. This plan should include a budget, a savings plan, and an investment strategy.

Achieving financial goals takes time and effort. However, by setting realistic goals and sticking to his plan, David Shands can increase his net worth and achieve his financial objectives.

Risk tolerance

Risk tolerance is a measure of an individual's willingness to take on risk in their financial decisions. It is an important factor to consider when assessing David Shands' net worth because it can significantly impact his investment strategy and overall financial well-being.

- Investment horizon: Individuals with a longer investment horizon typically have a higher risk tolerance. This is because they have more time to recover from market downturns. David Shands should consider his investment horizon when determining his risk tolerance.

- Financial goals: Individuals with aggressive financial goals may have a higher risk tolerance in order to potentially achieve greater returns. David Shands should consider his financial goals when determining his risk tolerance.

- Financial situation: Individuals with a stable financial situation may have a higher risk tolerance than those with a less stable financial situation. David Shands should consider his financial situation when determining his risk tolerance.

- Personality: Some individuals are naturally more risk-averse than others. David Shands should consider his own personality when determining his risk tolerance.

David Shands' risk tolerance is an important factor to consider when assessing his net worth. By understanding his risk tolerance, he can make more informed investment decisions and manage his financial risk more effectively.

Investment strategy

An investment strategy is a plan that outlines how an individual or organization will invest their money. It should be based on the individual's or organization's financial goals, risk tolerance, and time horizon. David Shands' investment strategy is an important factor in his net worth because it determines how his money is allocated and how much risk he is taking.

- Asset allocation: Asset allocation is the process of dividing an investment portfolio into different asset classes, such as stocks, bonds, and real estate. The goal of asset allocation is to diversify risk and achieve a desired level of return. David Shands' asset allocation will depend on his risk tolerance and time horizon.

- Investment selection: Once David Shands has determined his asset allocation, he needs to select specific investments within each asset class. This involves researching different investments and choosing the ones that he believes have the potential to meet his financial goals. David Shands should consider the following factors when selecting investments: the investment's risk, return potential, and liquidity.

- Rebalancing: Over time, the value of David Shands' investments will fluctuate. This can lead to his asset allocation becoming out of balance. Rebalancing is the process of adjusting the asset allocation to bring it back to its target levels. David Shands should rebalance his portfolio periodically, such as once per year.

- Monitoring: David Shands should monitor his investment performance regularly. This will help him to identify any problems early on and make necessary adjustments to his investment strategy. David Shands should review his portfolio at least once per year and make changes as needed.

Tax planning

Tax planning is the process of arranging one's financial affairs in a way that reduces tax liability. It can involve a variety of strategies, such as maximizing tax deductions and credits, investing in tax-advantaged accounts, and deferring income to lower tax rates in the future. Effective tax planning can significantly increase an individual's net worth by reducing the amount of money they pay in taxes.

- Retirement planning: One of the most important aspects of tax planning is retirement planning. By contributing to a tax-advantaged retirement account, such as a 401(k) or IRA, individuals can reduce their current tax liability and defer taxes on the earnings in the account until they retire. This can result in significant tax savings over the long term.

- Investment planning: Tax planning can also help individuals maximize the returns on their investments. By investing in tax-efficient investments, such as municipal bonds or index funds, individuals can reduce their tax liability and increase their after-tax returns.

- Estate planning: Tax planning can also help individuals minimize the tax liability on their estate when they pass away. By using trusts and other estate planning tools, individuals can reduce or eliminate estate taxes and ensure that their assets are distributed according to their wishes.

Tax planning is an important part of financial planning. By taking the time to plan ahead, individuals can significantly reduce their tax liability and increase their net worth. It is important to consult with a qualified tax advisor to develop a tax plan that meets your specific needs.

FAQs on David Shands' Net Worth

This section addresses frequently asked questions about David Shands' net worth, providing concise and informative answers to common queries.

Question 1: What is David Shands' net worth?

David Shands' net worth is an estimate of the total value of his assets minus his liabilities. It represents his financial wealth and is often used to assess his overall financial well-being.

Question 2: How is David Shands' net worth calculated?

David Shands' net worth is calculated by adding up the value of all his assets and subtracting the total amount of his liabilities. Assets include cash, investments, real estate, and personal property. Liabilities include debts, loans, and mortgages.

Question 3: What are the key factors that affect David Shands' net worth?

The key factors that affect David Shands' net worth include his income, expenses, investments, and debt. Changes in any of these factors can impact his net worth positively or negatively.

Question 4: How can David Shands increase his net worth?

David Shands can increase his net worth by increasing his income, reducing his expenses, making smart investments, and managing his debt effectively.

Question 5: What are the risks associated with David Shands' net worth?

The risks associated with David Shands' net worth include market fluctuations, economic downturns, and personal financial decisions. These factors can potentially lead to a decrease in his net worth.

Question 6: How can David Shands protect his net worth?

David Shands can protect his net worth by diversifying his investments, managing his debt wisely, and planning for the future. He can also consider seeking professional financial advice to make informed decisions.

In summary, David Shands' net worth is an important indicator of his financial well-being. By understanding the factors that affect his net worth and taking steps to protect and grow it, he can achieve his long-term financial goals and secure his financial future.

This concludes the FAQ section on David Shands' net worth.

Tips for Understanding David Shands' Net Worth

Understanding the concept of net worth is crucial for assessing David Shands' financial well-being. Here are six tips to help you grasp this important metric:

Tip 1: Know the FormulaNet worth is calculated by subtracting liabilities (debts) from assets (possessions). By understanding this simple formula, you can accurately determine David Shands' financial standing.Tip 2: Consider All AssetsAssets are not limited to cash and investments. They also include physical assets like real estate and personal property. A comprehensive understanding of all his assets provides a clearer picture of his financial health.Tip 3: Account for LiabilitiesLiabilities represent David Shands' financial obligations, including mortgages, loans, and credit card debt. By taking into account all liabilities, you can assess his debt burden and its impact on his net worth.Tip 4: Recognize Income and ExpensesIncome represents the money David Shands earns, while expenses are the costs he incurs. Tracking both income and expenses helps you understand his cash flow and its effect on his net worth.Tip 5: Understand Market FluctuationsAssets like stocks and real estate are subject to market fluctuations. By considering these fluctuations, you can anticipate potential changes in David Shands' net worth over time.Tip 6: Seek Professional AdviceConsulting a financial advisor can provide valuable insights into David Shands' net worth. They can help you analyze his financial situation, identify potential risks, and develop strategies to enhance his financial well-being.Understanding David Shands' net worth is essential for evaluating his financial health and making informed decisions. By following these tips, you can gain a comprehensive understanding of this important metric and its implications.In conclusion, David Shands' net worth serves as a snapshot of his overall financial standing. By considering various factors and seeking professional advice when necessary, you can effectively assess his financial well-being and make informed decisions.

Conclusion on David Shands' Net Worth

David Shands' net worth is a multifaceted indicator of his financial well-being. It encompasses his assets, liabilities, income, expenses, and investment strategies. Understanding the interplay of these factors is crucial for evaluating his overall financial health and making informed decisions.

As David Shands navigates the complexities of wealth management, it is important to consider the potential impact of market fluctuations, economic conditions, and personal financial choices. By implementing sound financial principles, seeking professional advice when necessary, and continuously monitoring his net worth, he can proactively manage his wealth and achieve his long-term financial goals.

Uncover The Impact Of Rakhshanda Hasan And Mehdi Hasan: Shaping India's Destiny

Uncover The Secrets: Unveiling The Influence Of Imani Duckett's Parents

Unveiling Katie Pavlich's Husband: A Journey Of Discovery

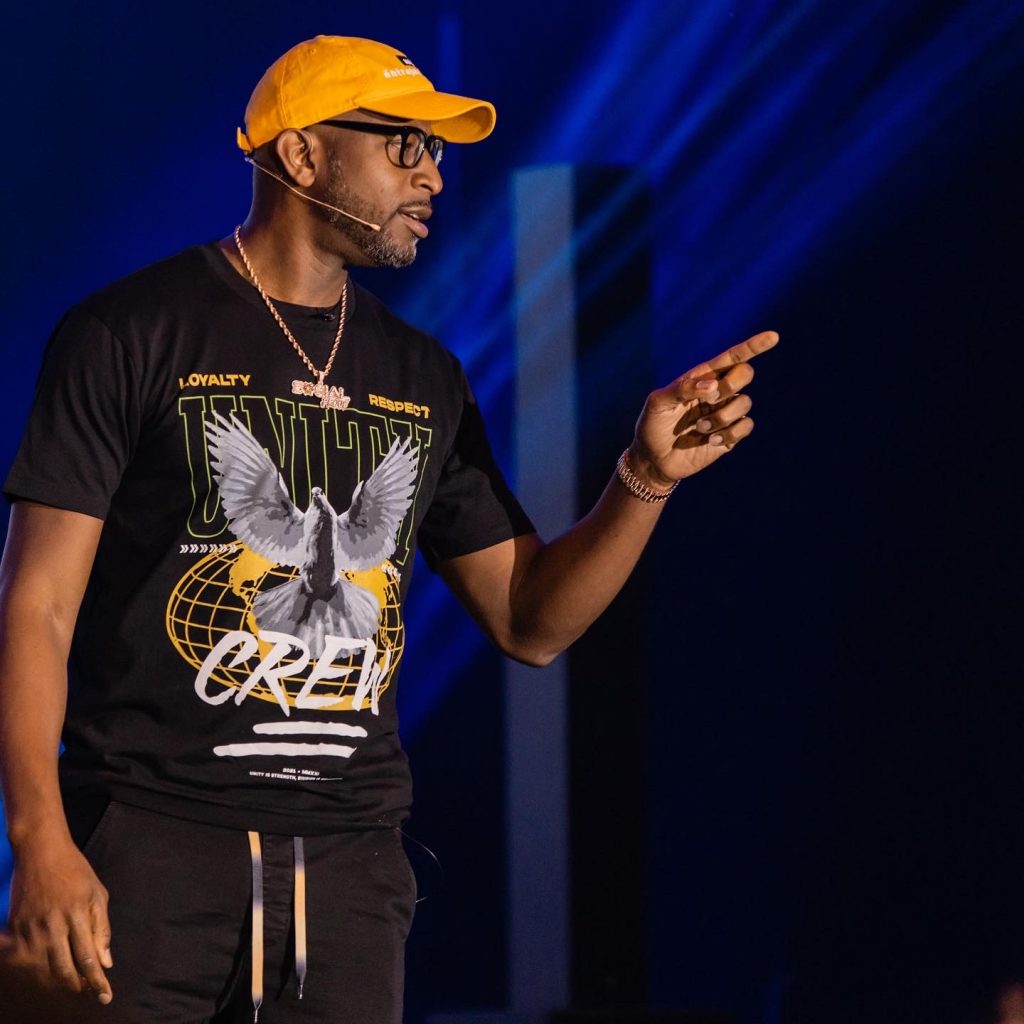

How David Shands Became The Multi Million Dollar Entrepreneur Coach

David Shands Is Proof That Humble Beginnings Should Not Limit Your

ncG1vNJzZmialaC2r7OTZ5imq2NjsaqzyK2YpaeTmq6vv8%2Bamp6rXpi8rnvDmq2inF2otaK6w6xkp52kYsSwvtOhZaGsnaE%3D