Paul Wall S Net Worth is a popular term used to describe the financial assets and value of a person or organization. It is often calculated by adding up the total value of all assets, such as cash, investments, and property, and then subtracting any outstanding liabilities, such as debts or loans.

Knowing Paul Wall S Net Worth can be important for a variety of reasons. It can help to assess an individual's financial health, make informed decisions about investments, and understand the overall economic landscape. Historically, tracking Paul Wall S Net Worth has been a key indicator of economic growth and stability.

In this article, we will explore the various factors that contribute to Paul Wall S Net Worth, discuss the importance of understanding financial assets, and provide insights into the historical development of Paul Wall S Net Worth as a financial metric.

Paul Wall S Net Worth

Paul Wall S Net Worth can be viewed through various essential aspects, each offering a unique perspective on his financial well-being:

- Assets: Properties, investments, and other valuable possessions

- Liabilities: Debts, loans, and other financial obligations

- Income: Earnings from various sources, such as music, endorsements, and investments

- Expenses: Personal and business costs, such as housing, transportation, and staff salaries

- Investments: Stocks, bonds, real estate, and other assets held for long-term growth

- Cash: Liquid assets readily available for immediate use

- Net Worth: Total assets minus total liabilities

- Financial Stability: A measure of an individual's ability to meet financial obligations and withstand financial shocks

Understanding these aspects provides insights into Paul Wall S Net Worth and his overall financial health. It can shed light on his financial decision-making, investment strategies, and long-term financial goals. By analyzing these aspects, we can gain a deeper understanding of Paul Wall S Net Worth and its significance in the financial landscape.

| Name | Net Worth | Age | Occupation |

|---|---|---|---|

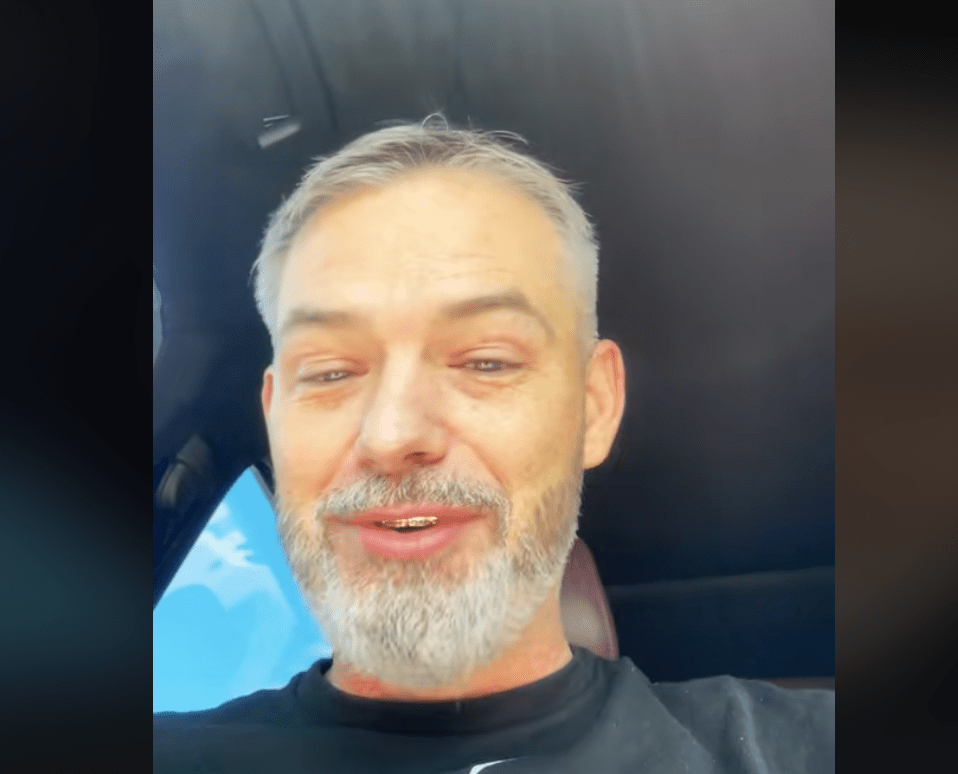

| Paul Wall | $14 million | 41 | Rapper, entrepreneur, actor |

Assets: Properties, investments, and other valuable possessions

Assets: Properties, investments, and other valuable possessions, form the foundation of Paul Wall S Net Worth. Assets represent the resources and wealth that an individual or organization owns and controls. These assets are crucial in determining the overall financial strength and stability of Paul Wall S Net Worth.

The value of Paul Wall S Net Worth is directly influenced by the value of his assets. For instance, if Paul Wall S Net Worth owns real estate properties that appreciate in value, his net worth will increase accordingly. Conversely, if the value of his investments declines, his net worth will be negatively impacted. Therefore, managing and growing assets are essential for maintaining and increasing Paul Wall S Net Worth over time.

Real-life examples of Paul Wall S Net Worth's assets include his luxurious Houston mansion, estimated to be worth millions of dollars, and his extensive collection of jewelry and watches. These assets contribute significantly to his overall net worth and reflect his financial success and wealth.

Understanding the connection between Assets: Properties, investments, and other valuable possessions and Paul Wall S Net Worth is crucial for several reasons. It provides insights into his financial stability, investment strategies, and long-term financial goals. By analyzing the composition and value of his assets, we can gain a deeper comprehension of Paul Wall S Net Worth and its significance in the financial landscape.

Liabilities: Debts, loans, and other financial obligations

Liabilities: Debts, loans, and other financial obligations are an integral part of Paul Wall S Net Worth, representing the financial burdens or debts that reduce his overall financial standing. Understanding the various facets of Liabilities: Debts, loans, and other financial obligations is crucial for gaining a comprehensive view of Paul Wall S Net Worth and his financial well-being.

- Outstanding Loans

Outstanding loans, such as mortgages or business loans, represent a significant portion of Paul Wall S Net Worth's liabilities. These loans require regular payments and can impact his cash flow and overall financial flexibility.

- Unpaid Invoices

Unpaid invoices and accounts payable are common liabilities for businesses like Paul Wall S Net Worth. These obligations can accumulate over time and strain his financial resources if not managed effectively.

- Taxes Payable

Taxes payable, such as income tax or sales tax, are ongoing liabilities that Paul Wall S Net Worth must fulfill. Failure to meet these obligations can result in penalties and legal consequences.

- Lawsuits and Contingencies

Lawsuits or legal claims can create contingent liabilities for Paul Wall S Net Worth. These potential obligations, if realized, can significantly impact his financial position.

Managing Liabilities: Debts, loans, and other financial obligations is essential for maintaining a healthy Paul Wall S Net Worth. By carefully monitoring and addressing his liabilities, Paul Wall S Net Worth can minimize financial risks, improve cash flow, and preserve his overall financial well-being.

Income: Earnings from various sources, such as music, endorsements, and investments

Income: Earnings from various sources, such as music, endorsements, and investments, represent the lifeblood of Paul Wall S Net Worth, providing the financial resources that sustain and grow his wealth. Understanding the different facets of Income: Earnings from various sources, such as music, endorsements, and investments is crucial for gaining a comprehensive view of Paul Wall S Net Worth and his financial success.

- Music Royalties

Music royalties from album sales, streaming platforms, and live performances constitute a major source of income for Paul Wall S Net Worth. His successful music career, spanning over two decades, has generated significant royalties that contribute to his overall wealth.

- Endorsements and Sponsorships

Paul Wall S Net Worth has leveraged his fame and influence to secure lucrative endorsement deals with various brands. These partnerships provide him with additional income streams and further enhance his net worth.

- Business Ventures

Beyond music, Paul Wall S Net Worth has expanded his income sources through various business ventures. These include clothing lines, restaurants, and real estate investments, which have contributed to his growing net worth.

The diverse income streams of Paul Wall S Net Worth provide him with financial stability and the ability to pursue new opportunities. By capitalizing on his talents, leveraging his brand, and making strategic investments, Paul Wall S Net Worth has built a substantial fortune and secured his financial future.

Expenses: Personal and business costs, such as housing, transportation, and staff salaries

Expenses represent the various outflows of resources used to sustain and grow an individual's or organization's wealth. In the case of Paul Wall S Net Worth, expenses encompass a range of personal and business costs that impact his overall financial standing.

- Housing

Housing expenses, including mortgage payments, property taxes, and maintenance costs for Paul Wall S Net Worth's luxurious Houston mansion, constitute a significant portion of his expenses.

- Transportation

Paul Wall S Net Worth's collection of luxury vehicles, including a Rolls-Royce and a Lamborghini, contributes to his transportation expenses. These vehicles require maintenance, insurance, and fuel, all of which impact his overall financial resources.

- Staff Salaries

As Paul Wall S Net Worth expands his business ventures, he incurs expenses related to staff salaries. These costs include wages, benefits, and payroll taxes for employees working in his various enterprises.

- Entertainment and Travel

Paul Wall S Net Worth's jet-setting lifestyle and frequent entertainment expenses contribute to his overall outflows. These costs include travel expenses, dining, and other recreational activities.

The careful management of Expenses: Personal and business costs, such as housing, transportation, and staff salaries is crucial for Paul Wall S Net Worth's financial well-being. Balancing these expenses against his income streams allows him to maintain a sustainable financial position and continue to grow his wealth over time.

Investments: Stocks, bonds, real estate, and other assets held for long-term growth

Within the context of Paul Wall S Net Worth, Investments: Stocks, bonds, real estate, and other assets held for long-term growth play a crucial role in shaping his overall financial landscape. These strategic placements represent a forward-looking approach to wealth management, aiming to generate passive income, appreciate in value, and provide a buffer against inflation.

- Stocks

Paul Wall S Net Worth's investment portfolio likely includes a diverse range of stocks, representing ownership shares in various publicly traded companies. These stocks have the potential to generate dividends and capital gains, contributing to his long-term financial growth.

- Bonds

Bonds, issued by governments and corporations, provide Paul Wall S Net Worth with a fixed income stream. These investments offer a lower risk profile than stocks but also typically yield a lower return.

- Real Estate

Real estate investments, such as rental properties or commercial buildings, form a significant portion of Paul Wall S Net Worth's portfolio. These assets have the potential to generate rental income, appreciate in value, and provide tax benefits.

- Alternative Investments

Paul Wall S Net Worth may also explore alternative investments, such as private equity, venture capital, or hedge funds. These investments often carry higher risks but have the potential for substantial returns.

Through a well-diversified investment portfolio, Paul Wall S Net Worth seeks to balance risk and reward, aiming to generate steady returns and preserve his wealth over the long term. These investments form an integral part of his financial strategy, contributing to his overall financial stability and growth.

Cash: Liquid assets readily available for immediate use

Within the realm of Paul Wall S Net Worth, Cash: Liquid assets readily available for immediate use stands as a crucial component, providing flexibility and liquidity to his financial portfolio. Cash encompasses various forms and serves essential purposes in managing his wealth.

- Physical Currency

Physical currency, including banknotes and coins, forms a tangible and easily accessible portion of Paul Wall S Net Worth's cash holdings, allowing for immediate transactions and purchases.

- Demand Deposits

Demand deposits, such as checking and savings accounts, offer Paul Wall S Net Worth convenient access to his cash through checks, debit cards, or online banking, providing liquidity for everyday expenses and short-term financial needs.

- Money Market Accounts

Money market accounts combine high liquidity with slightly higher interest rates than demand deposits, enabling Paul Wall S Net Worth to earn a small return on his cash holdings while maintaining easy access to funds.

- Certificates of Deposit (CDs)

Certificates of Deposit (CDs) offer a fixed interest rate for a specified period, providing Paul Wall S Net Worth with a secure and slightly higher return on his cash, although with limited access to funds until maturity.

The availability of Cash: Liquid assets readily available for immediate use empowers Paul Wall S Net Worth with financial flexibility, allowing him to seize investment opportunities, cover unexpected expenses, and maintain a stable financial footing amidst market fluctuations. Effective cash management is vital for Paul Wall S Net Worth, ensuring his financial preparedness and the ability to navigate both personal and business financial challenges.

Net Worth: Total assets minus total liabilities

Net Worth: Total assets minus total liabilities, serves as a cornerstone in understanding Paul Wall S Net Worth. It represents the financial position of an individual or organization, reflecting the value of their assets relative to their liabilities. A thorough analysis of Net Worth: Total assets minus total liabilities provides valuable insights into the overall financial health and stability of Paul Wall S Net Worth.

The calculation of Net Worth: Total assets minus total liabilities is straightforward. Total assets encompass all resources and possessions owned, including cash, investments, real estate, and other valuable items. Total liabilities, on the other hand, represent outstanding debts and obligations, such as mortgages, loans, and unpaid bills. By subtracting total liabilities from total assets, we arrive at Net Worth: Total assets minus total liabilities, which provides a snapshot of Paul Wall S Net Worth's financial standing.

A positive Net Worth: Total assets minus total liabilities indicates that the value of Paul Wall S Net Worth's assets exceeds his liabilities, suggesting a strong financial position. Conversely, a negative Net Worth: Total assets minus total liabilities implies that liabilities outweigh assets, potentially indicating financial distress or the need for debt restructuring.

Understanding the relationship between Net Worth: Total assets minus total liabilities and Paul Wall S Net Worth is crucial for several reasons. It allows for informed decision-making regarding investments, financial planning, and risk management. By regularly monitoring and analyzing Net Worth: Total assets minus total liabilities, Paul Wall S Net Worth can identify areas for improvement, optimize his financial strategy, and ensure long-term financial stability.

Financial Stability: A measure of an individual's ability to meet financial obligations and withstand financial shocks

Financial Stability: A measure of an individual's ability to meet financial obligations and withstand financial shocks, stands as a critical pillar in assessing Paul Wall S Net Worth. It encompasses the capacity to manage financial resources effectively, navigate unforeseen financial challenges, and maintain a sound financial footing over the long term.

A strong Financial Stability: A measure of an individual's ability to meet financial obligations and withstand financial shocks is a cornerstone of Paul Wall S Net Worth. It enables him to fulfill financial commitments, seize growth opportunities, and weather economic downturns without compromising his overall financial well-being. Conversely, a lack of Financial Stability: A measure of an individual's ability to meet financial obligations and withstand financial shocks can hinder Paul Wall S Net Worth's ability to achieve financial goals, increase his vulnerability to financial distress, and limit his capacity to respond to unexpected events.

Real-life examples within Paul Wall S Net Worth underscore the significance of Financial Stability: A measure of an individual's ability to meet financial obligations and withstand financial shocks. Paul Wall S Net Worth's diversified investment portfolio, prudent cash management, and strategic asset allocation contribute to his Financial Stability: A measure of an individual's ability to meet financial obligations and withstand financial shocks. These measures provide him with a buffer against market fluctuations, reduce his exposure to financial risks, and enhance his ability to withstand financial shocks.

Understanding the interplay between Financial Stability: A measure of an individual's ability to meet financial obligations and withstand financial shocks and Paul Wall S Net Worth offers practical applications for both individuals and organizations. By prioritizing Financial Stability: A measure of an individual's ability to meet financial obligations and withstand financial shocks, individuals can increase their resilience to financial challenges, make informed financial decisions, and achieve long-term financial well-being. Similarly, organizations can enhance their overall financial health, mitigate risks, and position themselves for sustainable growth by fostering a culture of Financial Stability: A measure of an individual's ability to meet financial obligations and withstand financial shocks.

In exploring the multifaceted aspects of Paul Wall S Net Worth, this article has shed light on various key insights and interconnections that contribute to his overall financial well-being. Firstly, Paul Wall S Net Worth's ability to generate income from diverse sources, including music, endorsements, and investments, provides him with financial stability and the ability to pursue new opportunities. Secondly, his strategic management of assets, liabilities, and expenses ensures the preservation and growth of his wealth over time.

Understanding Paul Wall S Net Worth extends beyond mere financial figures; it serves as a testament to the significance of financial literacy, prudent decision-making, and the power of building a diversified portfolio. By recognizing the interplay between different financial components, individuals and organizations can emulate Paul Wall S Net Worth's approach to financial management, fostering their own financial stability and achieving long-term financial success.

Explore The Unique Challenges And Growth Of Elham Ehsas Age And 10

Unveiling Jamie Lopez: Height, Weight, And Net Worth Explored

Clare Wren: Unraveling The Life And Legacy Of A Literary Icon

ncG1vNJzZmikmayyr7PKnmWsa16qwG7DxKyrZmpelrqixs6nmLCrXpi8rnvPmqylZaeWua150malnqxdrLyzwMdnn62lnA%3D%3D